|

|

Post by sunshine on May 8, 2021 19:03:21 GMT

Does Bezos personally not pay any income tax? I know Amazon has some sweet deals, but I've never heard of Bezos not paying taxes.

|

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 8, 2021 19:18:17 GMT

Does Bezos personally not pay any income tax? I don't believe anyone has made an assertion that he doesn't pay any federal, state, local income taxes. |

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 8, 2021 19:33:00 GMT

Just ask yourself...if you won a million dollars...would you give it all away? To answer your question, I would NOT give it all away. And I'm not advocating that the m/billionaires GIVE IT ALL AWAY - FFS. And we're not talking about a million. We're talking about HUNDREDS OF MILLIONS to BILLIONS. But, a lot of people are just hunk-the-dunk living in a country in which some can hoard BILLIONS while the homeless walk the streets in filth, pain and misery. That is NOT the world I aspire to. Hence my quest to tip it back to some semblance of equity. But many of you keep on arguing for the status quo. I'm sure it will just magically fix itself. If we just keep waiting for that amazing "trickle down" theory to work. PS - LOTS OF PEOPLE WORK HARD. FFS. You get rich because of the work of yourself AND OTHERS and LUCK - luck of the genes (intelligence, emotional intelligence, etc.) and/or luck of birth (parents, connections, family money, etc.) But yeah, "work hard". Like sanitation workers, nurses, bus drivers, etc. That'll fix it. So work hard and wait for trickle-down. Let's keep doing that!!! No, of course problems won’t magically fix themselves. And, really, Z, Dems do not subscribe to supply-side economics. They never did and they likely never will, so please stop throwing trickle-down at everybody. The majority of self-made millionaires and billionaires in this country did not build their wealth from having the right genes or being born in the right families. Luck? I don’t know what you mean by luck. Building a successful business rarely depends on luck. I know you get extremely frustrated by what you perceive as indifference and defense of the status quo, but understand, too, that everything is a trade-off and fairness is a subjective concept. What I’m willing to trade for something and what I consider fair is not what someone else thinks is acceptable, and vice versa. Magnify that by millions of people and millions of companies. Even our own party is not in agreement on how to pay for big plans which include investments in workers. It doesn’t mean we’ll just throw up our hands and say nothing can be done (which is essentially what you said to me on the other thread). It doesn’t mean that tax reforms aren’t necessary. The rise in economic inequality we’re experiencing is a complex problem that spans a multitude of areas – education costs, regulation/deregulation, monetary policies, automation, technology, outsourcing, political power, global competition, on and on. You can’t mitigate a complex problem like that with an overly-simplistic approach of transferring billions from the wealthy to the working class. Yes, taxation policies should be reformed so we get a fairer distribution of the burden and we get the revenue needed to improve the lives of the majority. But at some point, whether we want to admit it or not, when their taxes become too punitive, they will transfer that capital someplace else. With that capital go the jobs and the revenue. Finding that tricky balance is just that--tricky...and fraught with unintended consequences. That’s why I don’t really like oversimplifying issues like this. |

|

inkedup

Pearl Clutcher

Posts: 4,837

Jun 26, 2014 5:00:26 GMT

|

Post by inkedup on May 8, 2021 19:47:57 GMT

To answer your question, I would NOT give it all away. And I'm not advocating that the m/billionaires GIVE IT ALL AWAY - FFS. And we're not talking about a million. We're talking about HUNDREDS OF MILLIONS to BILLIONS. But, a lot of people are just hunk-the-dunk living in a country in which some can hoard BILLIONS while the homeless walk the streets in filth, pain and misery. That is NOT the world I aspire to. Hence my quest to tip it back to some semblance of equity. But many of you keep on arguing for the status quo. I'm sure it will just magically fix itself. If we just keep waiting for that amazing "trickle down" theory to work. PS - LOTS OF PEOPLE WORK HARD. FFS. You get rich because of the work of yourself AND OTHERS and LUCK - luck of the genes (intelligence, emotional intelligence, etc.) and/or luck of birth (parents, connections, family money, etc.) But yeah, "work hard". Like sanitation workers, nurses, bus drivers, etc. That'll fix it. So work hard and wait for trickle-down. Let's keep doing that!!! No, of course problems won’t magically fix themselves. And, really, Z, Dems do not subscribe to supply-side economics. They never did and they likely never will, so please stop throwing trickle-down at everybody. The majority of self-made millionaires and billionaires in this country did not build their wealth from having the right genes or being born in the right families. Luck? I don’t know what you mean by luck. Building a successful business rarely depends on luck. I know you get extremely frustrated by what you perceive as indifference and defense of the status quo, but understand, too, that everything is a trade-off and fairness is a subjective concept. What I’m willing to trade for something and what I consider fair is not what someone else thinks is acceptable, and vice versa. Magnify that by millions of people and millions of companies. Even our own party is not in agreement on how to pay for big plans which include investments in workers. It doesn’t mean we’ll just throw up our hands and say nothing can be done (which is essentially what you said to me on the other thread). It doesn’t mean that tax reforms aren’t necessary. The rise in economic inequality we’re experiencing is a complex problem that spans a multitude of areas – education costs, regulation/deregulation, monetary policies, automation, technology, outsourcing, political power, global competition, on and on. You can’t mitigate a complex problem like that with an overly-simplistic approach of transferring billions from the wealthy to the working class. Yes, taxation policies should be reformed so we get a fairer distribution of the burden and we get the revenue needed to improve the lives of the majority. But at some point, whether we want to admit it or not, when their taxes become too punitive, they will transfer that capital someplace else. With that capital go the jobs and the revenue. Finding that tricky balance is just that--tricky...and fraught with unintended consequences. That’s why I don’t really like oversimplifying issues like this. I agree that taxation is a complex issue. How do we decide which level of taxation is too "punitive"? Is it more punitive to expect Bezos and co. to pay 30, 40, or even 50 percent *WHICH WILL STILL LEAVE THEM WITH MORE MONEY THAN ANYONE ELSE ON EARTH*, or to ask a person making $60k a year to pay 30%? |

|

|

|

Post by Zee on May 8, 2021 20:09:46 GMT

I don't care about his yacht but good for all the boat builders who can get back to work.

I'm failing to see why anyone cares about this. Go live your life.

|

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 8, 2021 20:11:49 GMT

I agree that taxation is a complex issue. How do we decide which level of taxation is too "punitive"? Is it more punitive to expect Bezos and co. to pay 30, 40, or even 50 percent *WHICH WILL STILL LEAVE THEM WITH MORE MONEY THAN ANYONE ELSE ON EARTH*, or to ask a person making $60k a year to pay 30%? A person who has a taxable income of $60,000 incurs an effective tax rate of around 15% so I don’t know where you got 30%. Regardless, I’m not at all necessary in this pursuit of figuring out what is punitive and what isn’t for several reasons. First, I’m not an economist. Second, Biden has a whole team of economists advising him. Third, we have a Treasury Dept that studies tax policies and analyzes the risks and rewards. |

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 8, 2021 20:18:22 GMT

Let's say we keep tax policy where it is and Bezos gets to sit on BILLIONS (earning returns of MILLIONS/year) and he uses that money to buy a super-mega. The world gets people who are employed to build yachts.

OR

Let's say we taxed Bezos $500 million more (the cost of the yacht) in a year (or over a few years).

The government uses that money to employed to be mental health workers, doctors, road builders, teachers, etc. They too spend that money....

EITHER WAY PEOPLE ARE EMPLOYED.

The question is, which is MORE BENEFICIAL to the greater number of people? Which way leads to a world less likely to be thrown into violent revolution, pain, disease, misery.

In BOTH systems people are EMPLOYED. And they spend their EMPLOYMENT INCOME. But the product of their EMPLOYMENT benefits a few or many.

|

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 8, 2021 20:20:52 GMT

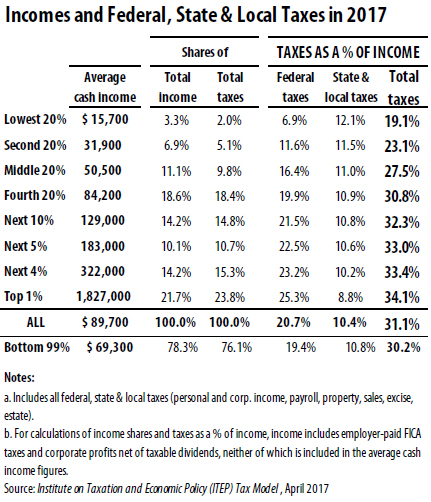

A person who has a taxable income of $60,000 incurs an effective tax rate of around 15% so I don’t know where you got 30%. Above a certain income level, we all pay about 30% all in (all taxes). I believe those earning tens to hundreds of millions should be paying closer to 40 or 50% marginal rates above a level - the level can be discussed. Lots of people flip out about that because they don't understand marginal rates.  |

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 8, 2021 20:35:34 GMT

You don’t pay the marginal tax rate. If your taxable income is $60,000 and you’re writing a check to Uncle Sam based on the portion of taxable income at the highest marginal tax rate of 22%, I highly recommend you switch accountants.

|

|

inkedup

Pearl Clutcher

Posts: 4,837

Jun 26, 2014 5:00:26 GMT

|

Post by inkedup on May 8, 2021 21:14:52 GMT

I agree that taxation is a complex issue. How do we decide which level of taxation is too "punitive"? Is it more punitive to expect Bezos and co. to pay 30, 40, or even 50 percent *WHICH WILL STILL LEAVE THEM WITH MORE MONEY THAN ANYONE ELSE ON EARTH*, or to ask a person making $60k a year to pay 30%? A person who has a taxable income of $60,000 incurs an effective tax rate of around 15% so I don’t know where you got 30%. Regardless, I’m not at all necessary in this pursuit of figuring out what is punitive and what isn’t for several reasons. First, I’m not an economist. Second, Biden has a whole team of economists advising him. Third, we have a Treasury Dept that studies tax policies and analyzes the risks and rewards. I thought we were having a discussion. Not sure where you got the idea that I was asking you to personally do or change anything. Have a nice weekend. |

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 8, 2021 21:20:40 GMT

You don’t pay the marginal tax rate. If your taxable income is $60,000 and you’re writing a check to Uncle Sam based on the portion of taxable income at the highest marginal tax rate of 22%, I highly recommend you switch accountants. Agreed. This doesn't address the fact that above a certain (<$100k) level, we all pay in the low 30%s - all-in tax burden. I think it should be SIGNIFICANTLY higher for those w/incomes above certain levels - which we can decide via debate and negotiation. But paying 34ish% all-in whether you make $100,000 or $100,000,000 is wrong, IMO. A comparison of 68% take-home of $68,000 vs. a 68% take-home of $68,000,000 is laughable. |

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 8, 2021 21:21:47 GMT

A person who has a taxable income of $60,000 incurs an effective tax rate of around 15% so I don’t know where you got 30%. Regardless, I’m not at all necessary in this pursuit of figuring out what is punitive and what isn’t for several reasons. First, I’m not an economist. Second, Biden has a whole team of economists advising him. Third, we have a Treasury Dept that studies tax policies and analyzes the risks and rewards. I thought we were having a discussion. Not sure where you got the idea that I was asking you to personally do or change anything. Have a nice weekend. Well, your question was: “How do we decide…” so I assumed “we” would include me. |

|

inkedup

Pearl Clutcher

Posts: 4,837

Jun 26, 2014 5:00:26 GMT

|

Post by inkedup on May 8, 2021 21:26:01 GMT

I thought we were having a discussion. Not sure where you got the idea that I was asking you to personally do or change anything. Have a nice weekend. Well, your question was: “How do we decide…” so I assumed “we” would include me. It's clear you're super passionate about this, but I'm not in the mood for a hyper aggressive discussion about the harm that might come if Jeff Bezos paid taxes like the rest of us. I meant "we" - societally, generally, royally. Again, have a nice weekend. |

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 8, 2021 21:33:02 GMT

Well, your question was: “How do we decide…” so I assumed “we” would include me. It's clear you're super passionate about this, but I'm not in the mood for a hyper aggressive discussion about the harm that might come if Jeff Bezos paid taxes like the rest of us. I meant "we" - societally, generally, royally. Again, have a nice weekend. Super passionate? Hyper aggressive? I just answered your question! And did so politely! |

|

inkedup

Pearl Clutcher

Posts: 4,837

Jun 26, 2014 5:00:26 GMT

|

Post by inkedup on May 8, 2021 21:35:07 GMT

It's clear you're super passionate about this, but I'm not in the mood for a hyper aggressive discussion about the harm that might come if Jeff Bezos paid taxes like the rest of us. I meant "we" - societally, generally, royally. Again, have a nice weekend. Super passionate? Hyper aggressive? I just answered your question! And did so politely! Forgive me for misreading your tone. I tend not to post long missives with many exclamation points unless I am very passionate about a subject. Your responses on this thread made me think is something you feel strongly about. |

|

|

|

Post by birukitty on May 8, 2021 23:19:06 GMT

Here are my thoughts: Obviously our current tax system needs to be overhauled. We've got millionaires and billionaires not paying their fair share of taxes because of loopholes and their ability to hide their assets in other countries-like Caribbean Islands. That needs to be fixed. In my mind what I'd like to see is a flat tax rate of a certain percentage (for illustration purposes ONLY let's make it 10% an easy number) for everyone. So if you make $100,000 a year you'd pay 10,000 in taxes a year. No deductions, no anything-it's a flat rate. If a person makes a much higher wage let's say $500,000 a year they'd pay $50,000 a year. Yeah, I know that sounds really high but this is just an example.

So the more you make the more you pay. No deductions, no loop holes, no hiding money in different countries. This way everyone pays their fair share. The more you make the more taxes you have to pay. This is the system I'd like to see but I'm not an economist and in fact in college the only class I ever got a D in was Economics so I might be completely wrong.

|

|

|

|

Post by nine on May 9, 2021 0:11:27 GMT

I very much dislike Lauren Sanchez. She was on a morning show in LA and I could not stand her.

|

|

lizacreates

Pearl Clutcher

Posts: 3,919

|

Post by lizacreates on May 9, 2021 0:18:18 GMT

In my mind what I'd like to see is a flat tax rate of a certain percentage (for illustration purposes ONLY let's make it 10% an easy number) for everyone. So if you make $100,000 a year you'd pay 10,000 in taxes a year. No deductions, no anything-it's a flat rate. If a person makes a much higher wage let's say $500,000 a year they'd pay $50,000 a year. Yeah, I know that sounds really high but this is just an example. The Republicans are actually the ones who’ve been wanting flat tax for a long time and it does have its advantages. For one thing, the tax code would be much simpler. The problem is if you eliminate credits, deductions and exemptions, the lower-income and middle class will be hit hard. Just to give you one example, the child tax credit. If your adjusted gross income is less than $75K for single, $150K for married, you get anywhere from $3,000 to $3,600 per child which is a direct reduction of tax you owe. For those with much lower incomes, this credit, coupled with exemptions, actually results in zero federal tax AND a refund despite no tax paid. For the middles class, they’d lose deductions and credits like property tax (that’s why Trump’s $10K cap on SALT was hated), IRA, mortgage interest, education credits, child care credits, etc. |

|

|

|

Post by chaosisapony on May 9, 2021 1:55:49 GMT

This is why I paid $25 more to go into my nearest little towns hardware store and buy something that I did have in my Amazon cart. I am a big Amazon shopper. I live in a rural area, so it isn't always easy to get what I need locally and of course the cost is almost always more when I shop local. But I really feel like I must try to keep what money I can away from him. I would hope others do the same. He needs to spend money on his EMPLOYEES! Not a trip to Mars or a new boat. Plus I got a nice visit in with the store owner. Supported MY town and I had it right away instead of sometime next week. Shop local - screw Bezos! He is an awful person. I totally agree. Where I live it takes me about a week to get anything with Amazon Prime. Sometimes I can just run down to the feed store or go 15 minutes down the road to the local hardware store and pick up what I need. Most of the time, the cost difference is negligible. For example, my horse's priobiotics are $14.99 on Amazon. They are $17 at the feed store. I happily buy them at the feed store every month. |

|

|

|

Post by papersilly on May 9, 2021 5:18:29 GMT

The creation of Amazon has enabled hundreds of thousands if not millions of other businesses to start or flourish. Anything from third party sellers, transportation, packaging, logistics, and more have started or grown as a result of Amazon. Jeff Bezos's back account was not the only one that grew. I would never begin to tell him what to do with his money because what we ask of one, we should all from many or all.

|

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 9, 2021 12:29:22 GMT

I would never begin to tell him what to do with his money because what we ask of one, we should all from many or all. Patently untrue. Marginal tax rates prove that. |

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 26, 2021 16:20:32 GMT

|

|

peppermintpatty

Pearl Clutcher

Refupea #1345

Refupea #1345

Posts: 4,209

|

Post by peppermintpatty on May 26, 2021 16:48:46 GMT

I can only hope it sinks with him on it.

eta: it was a joke. sorry if it offended some.

|

|

|

|

Post by pjaye on May 26, 2021 18:02:00 GMT

Alice Walton...61.8 Billion, more money than both of them combined Oprah's worth more than Zuckerberg...3.5 Billion. Are we only taxing rich men? Or just the rich men you have a personal vendetta against? I can only hope it sinks with him on it Should Oprah drown too? Maybe in her bath...would that make you happy? What about Alice, how would you like her to die? |

|

|

|

Post by busy on May 26, 2021 18:10:31 GMT

I can only hope it sinks with him on it. That's just gross. |

|

peppermintpatty

Pearl Clutcher

Refupea #1345

Refupea #1345

Posts: 4,209

|

Post by peppermintpatty on May 26, 2021 18:13:46 GMT

I can only hope it sinks with him on it. That's just gross. It was a joke! Seriously! |

|

Deleted

Posts: 0

Aug 18, 2025 20:11:40 GMT

|

Post by Deleted on May 26, 2021 19:29:34 GMT

It was a joke! Seriously! Let's not joke about people dying - even despicable ones. |

|

|

|

Post by Darcy Collins on May 26, 2021 20:09:23 GMT

It was a joke! Seriously! Let's not joke about people dying - even despicable ones. Despicable? Because he was smarter than you? He's donated 10 BILLION dollars last year - what have you done lately? |

|

|

|

Post by epeanymous on May 26, 2021 20:16:06 GMT

To point out, we do not have a state income tax in WA, even though we have both Gates and Bezos. We also tried as a city to tax Amazon to help address homelessness and he basically bought off the mayor to avoid it.

|

|

|

|

Post by Darcy Collins on May 26, 2021 20:25:31 GMT

To point out, we do not have a state income tax in WA, even though we have both Gates and Bezos. We also tried as a city to tax Amazon to help address homelessness and he basically bought off the mayor to avoid it. Washington had no state income tax long before Gates or Bezos. Voters can choose differently - but they haven't over and over again - but he's despicable and should drown. |

|