Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 13:11:57 GMT

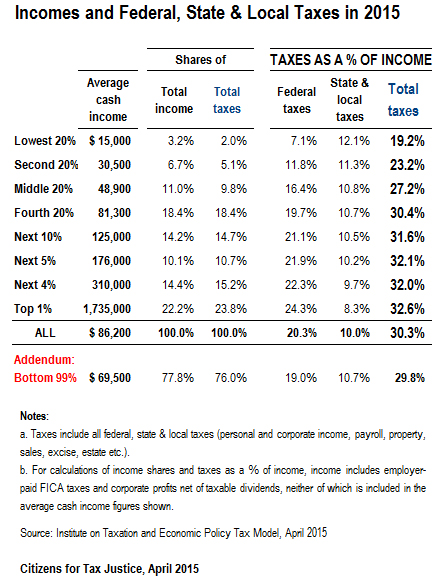

Let's remember there are: Personal Federal Income Taxes Personal State/Local Income Taxes (sometimes) Personal Federal Payroll Taxes Personal State/Local Property Taxes Personal State/Local Sales Taxes ..... Corporate Federal Taxes Corporate State Taxes Corporate Payroll Taxes Corporate State/Local Property Taxes (on Corporation-owned property) ..... The one Trump skipped out on for 10 out of 15 years, despite claims of wealth in the BILLIONS is the first one - Personal Federal Income Taxes.So, watch what the Trump camp says. When he says "I paid millions in taxes every year" remember he's purposely conflating all the personal taxes above. But Federal Income Taxes pay for the military he claims to love so much, and the courts he's trying to pack, and the roads and a variety of other block grants to the states for health, education, etc. So, when a BILLIONAIRE skips out on paying for all those needs of the regular guy/gal, guess who either picks up the slack or does without? The regular guy/gal. The ones bringing home $60,000 who pay THOUSANDS of their income in taxes making their take home pay have to stretch to cover food, shelter, insurance, health care, etc. While the self-professed BILLIONAIRE got to keep all the millions earned in 10 of the last 15 years - Federal Income Tax FREE. PS - One more reminder. In spite of the fact that the personal federal income tax is supposed to be progressive - meaning the wealthy are supposed to pay a larger % of their enormous incomes in tax, in reality and effectively they pay 30% all in. Meaning they pay the same as the middle class. In spite of what they would like you to believe.  ctj.org/pdf/taxday2015.pdf ctj.org/pdf/taxday2015.pdfPS - And that was BEFORE the Trump trillion-dollar tax CUT for the wealthiest. |

|

peabay

Prolific Pea

Posts: 9,941

Jun 25, 2014 19:50:41 GMT

|

Post by peabay on Sept 28, 2020 13:14:06 GMT

As my husband just said: "hm, look who actually IS defunding the police!"

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 13:17:17 GMT

|

|

|

|

Post by Darcy Collins on Sept 28, 2020 13:31:20 GMT

Personal federal income taxes ARE progressive. Your chart shows that they are progressive. State and local taxes are NOT progressive, which your chart also shows.

|

|

|

|

Post by Merge on Sept 28, 2020 13:35:47 GMT

Personal federal income taxes ARE progressive. Your chart shows that they are progressive. State and local taxes are NOT progressive, which your chart also shows. I think she means that there are more opportunities for tax write-offs and loopholes for the wealthy, so their actual tax rate tends to fall in the same percentage as (or lower than) the middle class. But I could be wrong. And will also defer to your expertise in financial matters. |

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 13:43:14 GMT

Personal federal income taxes ARE progressive. Your chart shows that they are progressive. State and local taxes are NOT progressive, which your chart also shows. I think she means that there are more opportunities for tax write-offs and loopholes for the wealthy, so their actual tax rate tends to fall in the same percentage as the middle class. But I could be wrong. And will also defer to your expertise in financial matters. They're very progressive ON PAPER. Effectively the chart shows the richest pay a small fraction more in fed. income taxes and NOWHERE NEAR the ON PAPER rates they like to tout. The chart also shows that EFFECTIVELY the richest billionaires pay the same all in rate for fed/state/local taxes as the middle class - low 30%. And that was BEFORE the Trump Trillion-dollar tax cut that benefited the wealthiest. |

|

|

|

Post by papercrafteradvocate on Sept 28, 2020 13:47:06 GMT

Honestly, it’s not solely the tax payments that concern me—

I want to know who owns his massive debt it’s all coming due in the next 1-4 years.

How did he get a security clearance with all that debt?

How did all this information get ignored during the vetting? Or was there none?

How was he entitled to a $72.9 million dollar refund?

How is the IRS allowing/justifying the deductions that normal everyday people wouldn’t be allowed to take? (I’m sure that trump will justify their hair expenses as legit because he’s a celebrity and public figure and it’s part of his business persona)

If trump has inflated property for loans, then devalued them for taxes, this will be found out. And hopefully they’ll be held accountable.

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 13:49:38 GMT

I don't care that he has business mortgages - lots of businesses do.

And when they come due, they roll them over again.

I DO care that he has personally backed these mortgage loans.

And I DO CARE TO WHOM HE IS INDEBTED.

The American people should know if he's indebted to American banks/companies? or to Russians? Or other geopolitcally-sensitive banks or billionaires.

|

|

garcia5050

Pearl Clutcher

Posts: 2,773  Location: So. Calif.

Location: So. Calif.

|

Post by garcia5050 on Sept 28, 2020 13:55:48 GMT

And I DO CARE TO WHOM HE IS INDEBTED. The American people should know if he's indebted to American banks/companies? or to Russians? Or other geopolitcally-sensitive banks or billionaires. We already know that no American bank would lend to him. His history of bankruptcy and nonpayment stopped all that. We know it’s foreign money, but from where? |

|

|

|

Post by Merge on Sept 28, 2020 14:06:10 GMT

And I DO CARE TO WHOM HE IS INDEBTED. The American people should know if he's indebted to American banks/companies? or to Russians? Or other geopolitcally-sensitive banks or billionaires. We already know that no American bank would lend to him. His history of bankruptcy and nonpayment stopped all that. We know it’s foreign money, but from where? Some from Deutschebank, right? We already know that. But I'm sure we'll also find out that Russia, the Saudis, and possibly the Iranians and Chinese have lent him money. |

|

scorpeao

Pearl Clutcher

Posts: 4,524

Location: NorCal USA

Jun 25, 2014 21:04:54 GMT

|

Post by scorpeao on Sept 28, 2020 15:14:44 GMT

The entire country should be outraged that we all pay more taxes than DJT. But nope, his supporters are saying "good for him."

|

|

|

|

Post by epeanymous on Sept 28, 2020 15:18:59 GMT

I have posted this before — my extremely wealthy in-laws (they are not billionaires, but they are ... affluent) for two decades paid zero (0) in federal income taxes, completely lawfully. I am not going to put their personal tax stuff out on the Internet, but suffice it to say that there are tax loopholes that are only available to very wealthy people.

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 15:35:42 GMT

I have posted this before — my extremely wealthy in-laws (they are not billionaires, but they are ... affluent) for two decades paid zero (0) in federal income taxes, completely lawfully. I am not going to put their personal tax stuff out on the Internet, but suffice it to say that there are tax loopholes that are only available to very wealthy people. Naturally. It’s good to buy the laws. Spend a couple million, save tens or hundreds of millions. |

|

|

|

Post by pierogi on Sept 28, 2020 15:39:33 GMT

And I DO CARE TO WHOM HE IS INDEBTED. The American people should know if he's indebted to American banks/companies? or to Russians? Or other geopolitcally-sensitive banks or billionaires. We already know that no American bank would lend to him. His history of bankruptcy and nonpayment stopped all that. We know it’s foreign money, but from where? Rhymes with Russia. Laundered through Deutsche Bank. |

|

|

|

Post by Darcy Collins on Sept 28, 2020 16:16:19 GMT

Personal federal income taxes ARE progressive. Your chart shows that they are progressive. State and local taxes are NOT progressive, which your chart also shows. I think she means that there are more opportunities for tax write-offs and loopholes for the wealthy, so their actual tax rate tends to fall in the same percentage as (or lower than) the middle class. But I could be wrong. And will also defer to your expertise in financial matters. Those are actual rates in the above chart showing effective rates for the different income groups - it's already a little skewed as they include payroll taxes which are also not progressive. If you look at the effective rate by quintile on the IRS site for just federal income rates you actually see that the bottom quintile is actually negative. I'm not saying there aren't loopholes - and one can argue if the effective rates are high enough - but you absolutely cannot argue that FEDERAL INCOME taxes aren't progressive. And if you want to address the amount of income that lower and middle income people pay in taxes you have to address it on the state and local level and/or through payroll taxes. |

|

twinsmomfla99

Pearl Clutcher

Posts: 4,118

|

Post by twinsmomfla99 on Sept 28, 2020 16:16:44 GMT

I wonder how much Russian assistance he got from "birth tourism" at his properties? secondnexus.com/news/russians-birth-tourism-anchor-babiesThanks to Trump (and others), we have thousands of U.S. citizens by birth who are being raised in Russia. They can legally enter the U.S. as adults with little vetting. |

|

|

|

Post by Darcy Collins on Sept 28, 2020 16:27:19 GMT

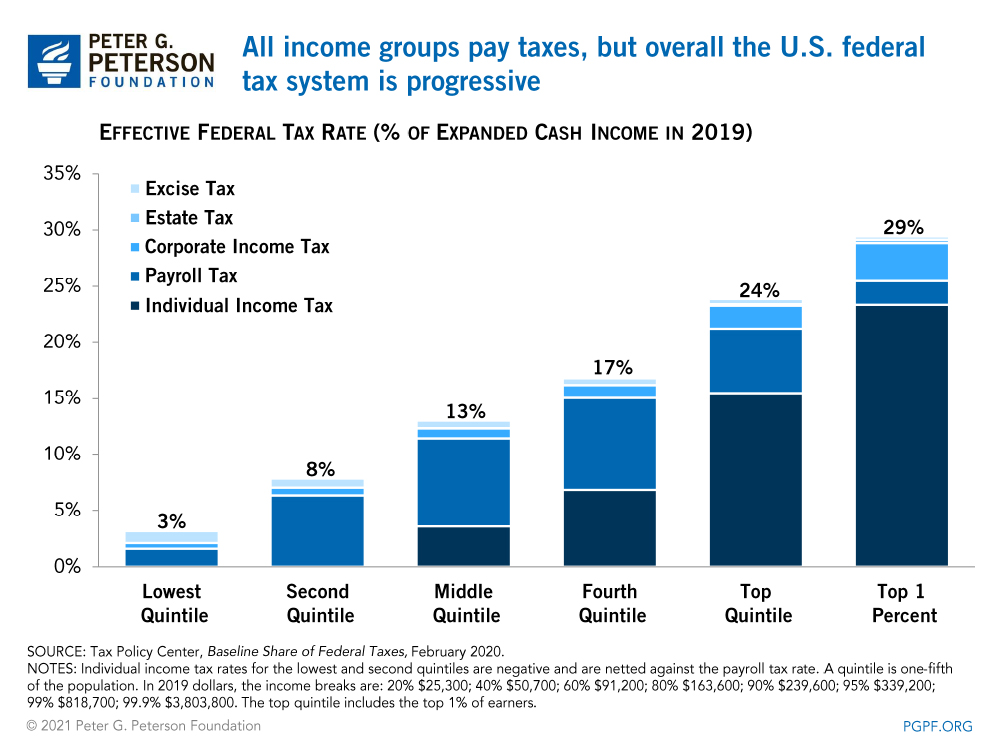

FYI a good graph that shows how taxes other than federal income taxes make up the vast majority of the taxes most Americans pay - you have to be in the upper quintile before your federal income taxes exceed your payroll taxes:  www.pgpf.org/budget-basics/who-pays-taxes www.pgpf.org/budget-basics/who-pays-taxes |

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 16:43:50 GMT

FYI a good graph that shows how taxes other than federal income taxes make up the vast majority of the taxes most Americans pay - you have to be in the upper quintile before your federal income taxes exceed your payroll taxes: www.pgpf.org/budget-basics/who-pays-taxesInteresting that they add ' corporate income tax' so that the % is higher for the wealthiest. Interesting that they "net" the negative income taxes against payroll taxes. Otherwise it's similar to the numbers by CTJ. Bottom line is that though federal income tax is mildly progressive, the overall tax burden on the wealthiest and the middle is approx. the same in the low 30%. Though the rich would have you believe they're paying a much higher tax burden than the middle class. |

|

|

|

Post by lisae on Sept 28, 2020 17:08:03 GMT

And remember he just changed his place of residence from New York to Florida which does not have personal income tax.

|

|

|

|

Post by Merge on Sept 28, 2020 17:09:31 GMT

FYI a good graph that shows how taxes other than federal income taxes make up the vast majority of the taxes most Americans pay - you have to be in the upper quintile before your federal income taxes exceed your payroll taxes:  www.pgpf.org/budget-basics/who-pays-taxes www.pgpf.org/budget-basics/who-pays-taxesThanks for this info. This would seem to imply, though, that either Trump has done something illegal/fraudulent to reduce his tax burden so greatly, or else many of the richest folks in the country are also paying no income tax through the same legal means Trump used. |

|

|

|

Post by Darcy Collins on Sept 28, 2020 18:11:09 GMT

FYI a good graph that shows how taxes other than federal income taxes make up the vast majority of the taxes most Americans pay - you have to be in the upper quintile before your federal income taxes exceed your payroll taxes: www.pgpf.org/budget-basics/who-pays-taxesThanks for this info. This would seem to imply, though, that either Trump has done something illegal/fraudulent to reduce his tax burden so greatly, or else many of the richest folks in the country are also paying no income tax through the same legal means Trump used. So real estate investment is one of the more generous areas for legal tax breaks for individual federal income tax, so with depreciation expense alone, I'd expect his income tax rate to be much lower than average for his income bracket. It's not too different than the many individuals who own a rental house or two and find that even though they're cash flow positive, after depreciation expense there's little income to report on taxes or even losses - just on a much, much bigger scale. There's a ton of variability on how easy it is to shield income. There are certainly people who've managed to pay extraordinarily low to no taxes in any given year absolutely legally - usually as they have a short term loss. And as I said, depending on the nature of the income, makes it easier or harder to shield the income. 10/15 years of no taxes would imply some pretty aggressive accounting maneuvers. I haven't had a chance to look at the NYTimes info in any detail, but have heard he was also very aggressive with expenses - some may or may not be legal. You can look at the effective rates for 1%, .1% and .01% and 0.001% You find that there are certainly either a different mix (more and more income from capital gains with lower rates and/or more opportunity for deductions as the 1,412 returns in the 0.001% rate have an average effective rate at 23.9% is lower than the top 4% - and you might be averaging some extremely low tax payers and the number is low enough that a few super lower payers would skew the number lower even if the other 1,000 returns were paying a high rate. But those 1,402 richest of the rich paid $51.4 billion in taxes.  |

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 28, 2020 18:41:38 GMT

So the top 4% pay about 25% effective rate. At the tippy top, an average income of $152 MILLION ($214,647,000,000 (as $ figures are in 000s / 1412 returns) in the top .001.

So they take home $114 MILLION (75% of that).

But someone in the middle class (top 50%) average income is $127,000. They take home $108,000. Out of which they pay for health care, housing, education, etc.

And we think we have a fair federal income tax code.

We think it's totally OK for a family to take home $114 MILLION (in one year mind you - returns on that one year income ALONE at 5% being more than most families will make a in lifetime).

In my ideal world, NO ONE would be able to take home that much money income. Out of $152 MILLION maybe they could take home $25 MILLION, MAYBE?!?!? More than that is OBSCENE while homeless vets wander the streets, people are in dire need of mental health care, child care, etc.

But, that's our system.

If we took the incomes over $25MM from the IRS chart above and taxed them at 99% over $25MM - we could raise about $300,000,000,000/year (that's $300 BILLION/year) on those incomes (The whole .001% and 1/3 of the .01% richest).

Some might say, "No one would work for over $25MM then, why earn more than $25MM if all the money over $25MM is taxed away?" Two answers: 1. Some people still want the $50MM salary/payout for bragging rights - even if you "only" get to keep $25MM. 2. If they don't want any money over $25MM that's fine - let other entrepreneurs come in and do that work or get that money - instead of all that money being funneled into the hands of one obscenely rich person.

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 29, 2020 17:44:54 GMT

This is what YOU want America. This is what YOU vote for. What YOU allow by not protesting, not voting, not donating, not paying attention.

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 29, 2020 17:59:17 GMT

|

|

lindas

Pearl Clutcher

Posts: 4,306

|

Post by lindas on Sept 29, 2020 18:33:11 GMT

This is what YOU want America. This is what YOU vote for. What YOU allow by not protesting, not voting, not donating, not paying attention. 1951 was the year of the 85th Congress. Currently it’s the 116th Congress. Tax laws are written in the House and the House has been controlled by the Democratic Party 24 times during that span. They had control of the Senate 21 times. So you’re right, this is what YOU are voting for. You can’t lay all the blame on one party, they both share in the inequality. |

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 29, 2020 18:48:50 GMT

This is what YOU want America. This is what YOU vote for. What YOU allow by not protesting, not voting, not donating, not paying attention. 1951 was the year of the 85th Congress. Currently it’s the 116th Congress. Tax laws are written in the House and the House has been controlled by the Democratic Party 24 times during that span. They had control of the Senate 21 times. So you’re right, this is what YOU are voting for. You can’t lay all the blame on one party, they both share in the inequality. Nope. False equivalence. But it is what the VOTERS are voting for. |

|

MizIndependent

Drama Llama

Quit your bullpoop.

Quit your bullpoop.

Posts: 5,836

Jun 25, 2014 19:43:16 GMT

|

Post by MizIndependent on Sept 29, 2020 19:26:51 GMT

|

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 29, 2020 21:14:44 GMT

Too many Americans are moronic when it comes to taxes and have no idea how marginal rates work. They hear 60% and they blow a gasket. They also seem too stupid to understand that it's better to pay higher taxes than lower taxes + insane out-of-pocket medical expenses (e.g.) if the higher taxes < lower taxes + insane out-of-pocket expenses. Billionaires have won the information war: Too many pay lower tax rates than the middle class while the middle class fights their battles for them in keeping marginal rates insanely low. |

|

MizIndependent

Drama Llama

Quit your bullpoop.

Quit your bullpoop.

Posts: 5,836

Jun 25, 2014 19:43:16 GMT

|

Post by MizIndependent on Sept 29, 2020 21:31:44 GMT

They also seem to stupid to understand... *too  From the article I posted above: "First off, 'morality' doesn’t have jack shit to do with taxation. You pay what you legally owe. Nobody willingly pays the government more than they legally owe." "Every single person who barks about how somebody else should be paying more? They themselves are paying the minimum they can get away with. As they should. As should you." |

|

Deleted

Posts: 0

Nov 26, 2024 1:58:11 GMT

|

Post by Deleted on Sept 29, 2020 21:37:06 GMT

From the article I posted above: "First off, 'morality' doesn’t have jack shit to do with taxation. You pay what you legally owe. Nobody willingly pays the government more than they legally owe." "Every single person who barks about how somebody else should be paying more? They themselves are paying the minimum they can get away with. As they should. As should you." The "minimum they can get away with" needs to be a lot higher. A LOT. |

|